Are the ever-increasing costs of groceries stressing you out? You might want to consider getting one of these best credit cards for grocery stores to help you take the sting out and earn some free travel or cash-back in return!

It’s not a secret that groceries are getting more and more expensive. My little Beckham wanted a big bag of Cheetos Puffs the other day as we were checking out and it was over 7 dollars! Ummm… what? If you are like me and wondering how on this green earth is anyone affording anything these days and if buying groceries is starting to stress you out, it might be time to take a look at getting a credit card with reward grocery spend. So that you can earn extra points or cash-back on those groceries that you are buying!

*If you are just getting started with Reward Travel or Travel Hacking, you might want to check out Reward Travel 101 here!

*All information about Chase cards has been collected independently by Our Family Passport, and are not available through MileValue.

Table of Contents

The 6 Best Credit Cards for Grocery Stores

As a mom of a blended family of six, we spend A LOT on groceries. Because I am always trying to watch my budget and figure out how I can maximize my spending I have spent hours learning from trial and error and researching the best credit cards for grocery stores to help you determine what one is right for you!

These 6 cards are all over 3X or 3% or more back, are easy to use, easy to transfer points or book travel, and will help you earn free travel or cashback just on the food that you have to buy every day!

Keep in Mind – Budget over Points!

Keep in mind that you still want to stay within your budget when buying groceries! These cards are meant to supplement your spending. Don’t go blow your money on a bunch of food you won’t each just because you are getting 6% cashback!

The Absolute 6 Best Credit Cards for Grocery Stores

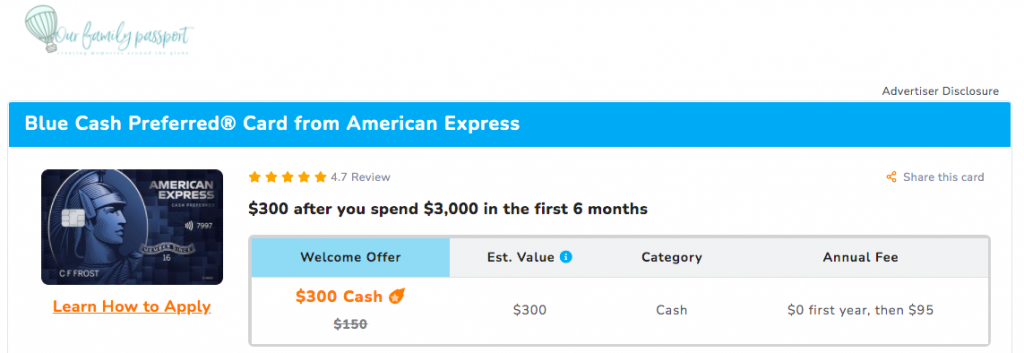

Blue Cash Preferred® Card from American Express

- Welcome bonus – $300.00

- Annual fee – $0 for the first year then $95.00

- 6% cashback on groceries at US Supermarkets

Apply for the Blue Cash Preferred here!

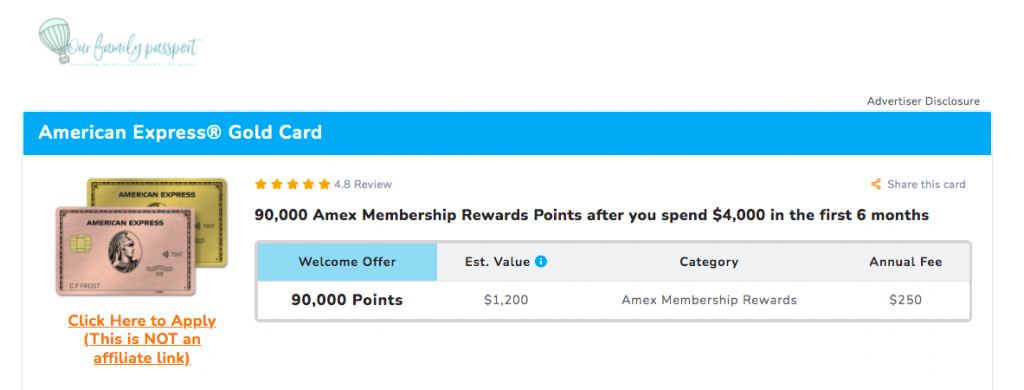

American Express® Gold Card

- Welcome bonus – 90k points through my link, it is normally 60k!

- Annual fee – $250.00

- 4x back on groceries at US Supermarkets

- (Yes, this card has a bit higher annual spend but it has so many other really amazing bonuses and this is hands down one of my favorite all-time cards!)

Apply for the American Express® Gold Card here!

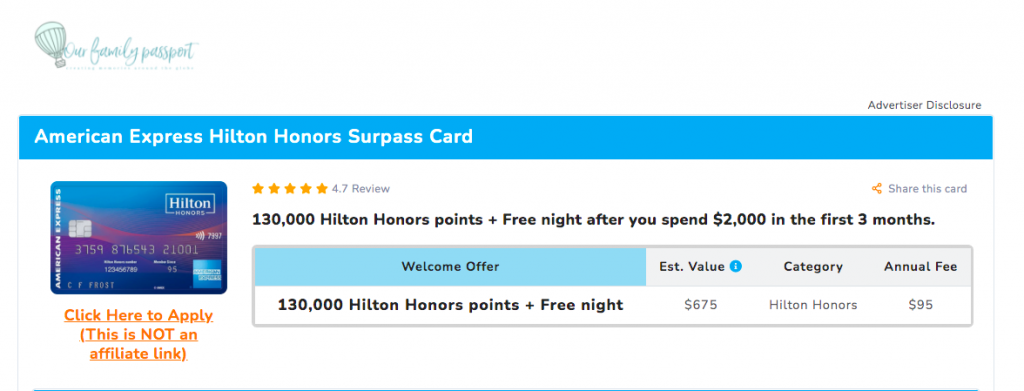

Hilton Honors Surpass

- Welcome bonus – 130k points

- Annual fee – $95

- 6x back on groceries at US Supermarkets

- (6x the points are great! However, keep in mind that Hilton points are valued less than Chase or Amex points)

Apply for Hilton Honors Surpass here!

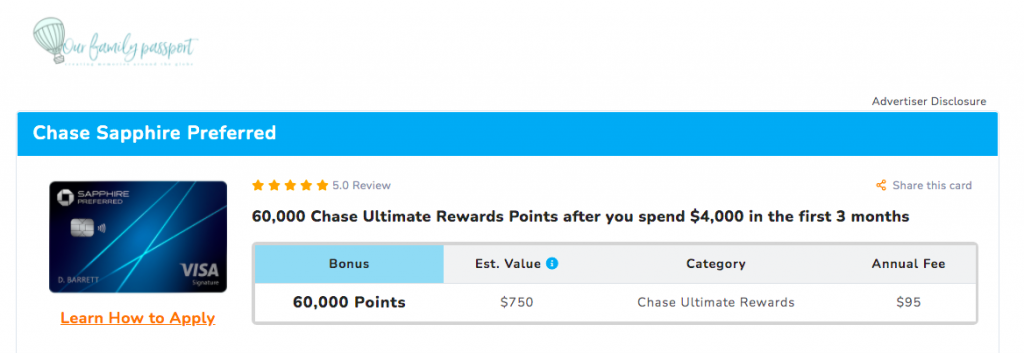

Chase Sapphire Preferred® Card

- Welcome bonus – 60k points

- Annual fee – $95

- 3x the points on online groceries

- (I answer just what does “online grocery” mean below)

Apply for Chase Sapphire Preferred® Card here!

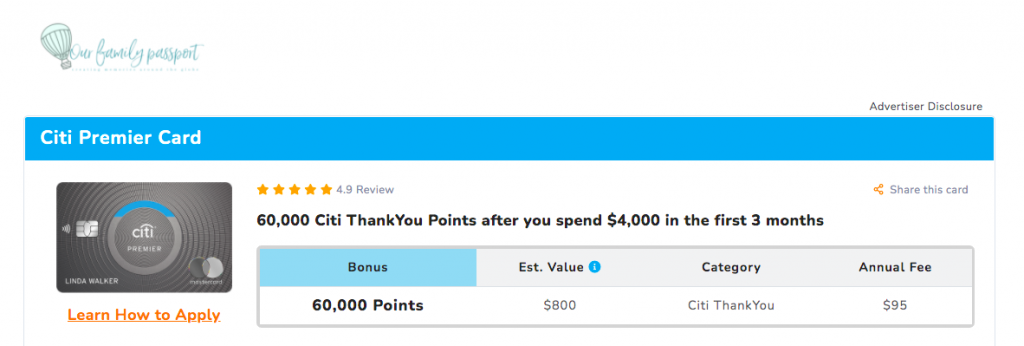

Citi Premier® Card

- Welcome bonus – 60k points

- Annual fee – $95

- 3x back on groceries at US Supermarkets

Apply for Citi Premier® Card here!

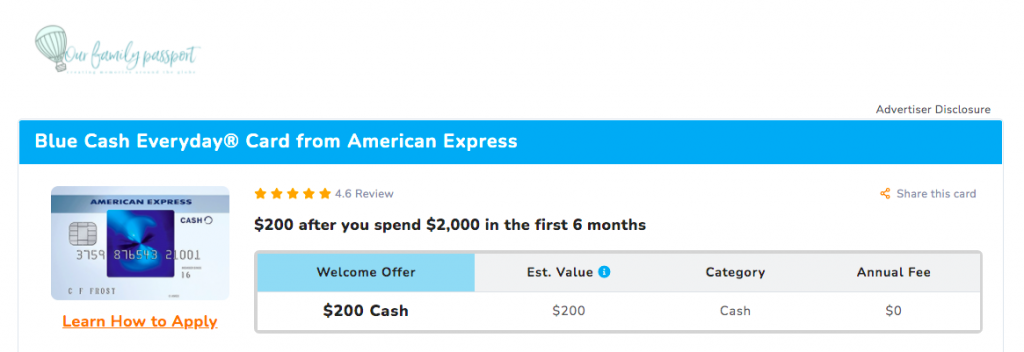

Blue Cash Everyday® Card from American Express

- Welcome bonus – $200

- Annual fee – 0

- 3% cashback on groceries at US supermarkets

- An amazing card for a zero annual fee!

Apply for Blue Cash Everyday® Card from American Express here!

Some Common Questions About Grocery Store Spend and Rewards

Is Costco considered a grocery store for credit cards?

Costco does NOT count as a grocery store with any credit cards and you can not use your Amex there. Anything that is wholesale or clubs like Sam’s Club, or bigger retailers like Walmart or Target do not count as supermarkets. However, an awesome workaround is that Instacart DOES count so you can use your Chase Sapphire Preferred® Card to order your goods and groceries from Costco and still get your 3x back!

Is Trader Joe’s a supermarket for Amex?

Yes! For all of your Trader Joe’s fans, it does qualify as a supermarket and gets the grocery store bonus through Amex!

Which type of card gives you cash back at grocery stores?

The best cashback card for supermarkets and grocery stores is hands down the Blue Cash Preferred® Card from American Express at 6% cashback!

Is Walmart considered a grocery store for credit cards?

Unfortunately no, it does not! However, if you use Instacart and purchase your groceries online then you can still get points back!

What counts as online grocery for Chase Sapphire Preferred® Card?

The online grocery (excluding Target, Walmart, and wholesale clubs) category includes purchases for grocery pickup and delivery that are placed online through grocery store merchants like Kroger and smaller supermarkets. In other words, if you place a Walmart+ order it will not be counted as grocery but if you get groceries through a place like Kroger or Albertsons it will.

Does Instacart count for Chase Sapphire Preferred® ?

Yes! This is a fantastic workaround! If you use Instacart and the service is billed through Instacard and NOT Costco, or Walmart then purchases should still be categorized as groceries that trigger the bonus earning or cashback rate.

To see Chases’s retailer and supermarket guidelines click here – Chase Reward Category FAQ

Does Amex consider Instacart a grocery store?

Yes! Instacart counts as a supermarket or grocery store for Amex and has been coded as such! This means that as long as this program is in place and you order groceries through Instacart for the bigger wholesale clubs you should still be earning points!

To see Amex’s retailer and supermarket guidelines click here – Amex Membership Rewards Info

Does Chase consider Target a grocery store?

Like Walmart, Costco, and Sam’s Club Target is not considered or coded as a grocery store.

Picking the Best Grocery Rewards Credit Card for You and Your Family!

You are going to have to buy groceries right? Might as well make some money back and know that when your son is chomping down on a 7 dollar bag of cheet0s (I still want to cry) that you are on your way to earning a free trip!