Hey there! If you’re ready to make the most of your Chase Ultimate Rewards points, you’re in the right place. This article will show you how transferring your Chase points can double or triple the value of your points so you can travel more for less with your crew! Plus, we’ll walk you through exactly how to do it!

Our Family Passport has partnered with CardRatings for our coverage of credit card products. Our Family Passport and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Table of Contents

Why Transfer Your Points?

The beauty of Chase Ultimate Rewards points is their flexibility. Transferring these points to airline and hotel partners can increase their value versus redeeming them directly through Chase Travel℠ (Chase’s booking platform). This flexibility means you can access first-class flight seats or luxury hotel suites for fewer points—who wouldn’t love that?

Expert Tip: Sometimes booking through Chase Travel℠ might make more sense. This is a rare occurrence, but it does happen. I always like to quickly price out my booking options through the travel portal and the transfer partner. It takes an extra 5 minutes and can help you save tons of points.

What Happens When I Transfer My Points?

Transferring your Chase Ultimate Rewards points to a hotel or airline loyalty program converts them from flexible Chase points to the points of the transfer partner. For example, if I transfer my Chase points to Hyatt – those transferred points become World of Hyatt points that can be used to book Hyatt hotels directly. This can be AMAZING because a $1,000 Hyatt hotel booked through Chase Travel℠ would cost me roughly 85k to 100k points a night. However, once I transfer those points, I can book through Hyatt and get that same hotel for anywhere between 30-40k points a night.

Chase isn’t the only card issuer that offers transferrable points. I also LOVE American Express and Capital One for their flexible point programs. You can check out the Amex Transferring to Delta Guide here.

The Caveat:

Once you transfer your points, you cannot transfer them back. Because of this, it’s best practice only to transfer what you need for a specific booking and ensure the booking is available.

My Favorite Chase Cards that Earn Flexible Chase Ultimate Rewards

These three are my favorite cards for earning a lot of Chase Ultimate Rewards, which you can then quickly transfer to any of the Chase Transfer Partners! They are the Chase Sapphire Preferred® Card, the Ink Business Preferred® Credit Card, and the Chase Sapphire Reserve® (although I don’t recommend the Reserve for everyone because of the high annual fee – if you’re looking for a lower annual fee personal option, the Sapphire Preferred is where it’s at). Also, there is a limited-time incredible elevated offer alert on the Chase Sapphire Preferred that has quite literally blown my mind.

If you apply for one of these cards, THANK YOU so much for using my links! Your support of my small business is so appreciated, and comes at no extra cost to you!

Check out all of the best credit cards here!

My Favorite Chase Cards that Transfer & Allow You to Transfer!

Once you hold any one of these three cards, you can transfer your points from ANY card that earns Chase Ultimate Rewards.

- Chase Sapphire Preferred® Card

- Ink Business Preferred® Credit Card

- Chase Sapphire Reserve®

For example, if you hold the Chase Freedom Flex® or the Ink Business Unlimited® Credit Card and have one of these three cards, all of the points earned from any card earning Chase Ultimate Rewards can be transferred.

Check out all of the best credit cards here!

How to Transfer Your Chase Points Effectively

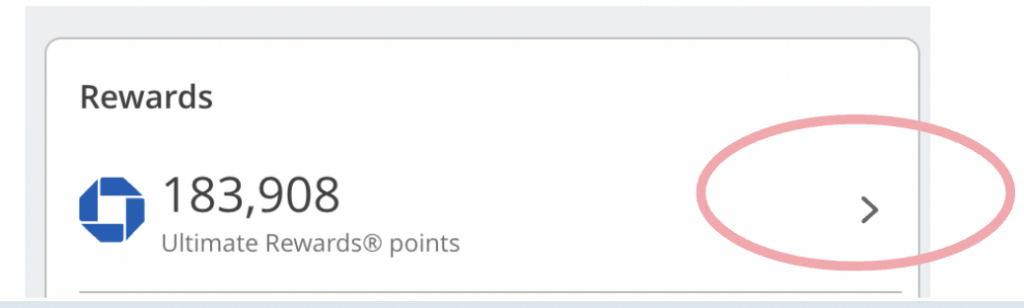

1.Log into your Chase Account

- Start by logging into your Chase online account. Then, navigate to the Ultimate Rewards dashboard, where you can track your points and explore transfer partners.

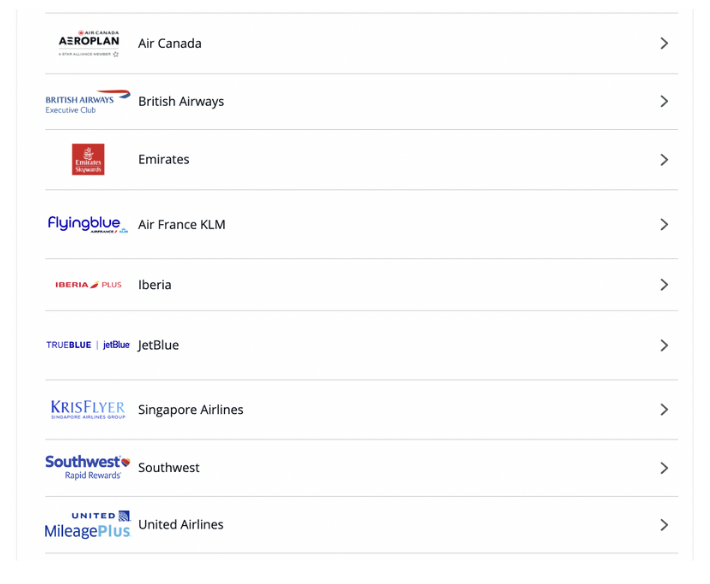

2. Choose a Transfer Partner:

- Chase has some pretty amazing airline and hotel transfer partners like Hyatt, Marriott, United, Southwest, Virgin Atlantic, and more! Take some time to explore which partner can work best for your upcoming travel plans. Don’t forget to check if there are any transfer bonuses available.

Hot Tip:

Our favorite transfer partners are Hyatt, FlyingBlue, Virgin Atlantic, Singapore Airlines, and sometimes Marriott if there is a good transfer bonus!

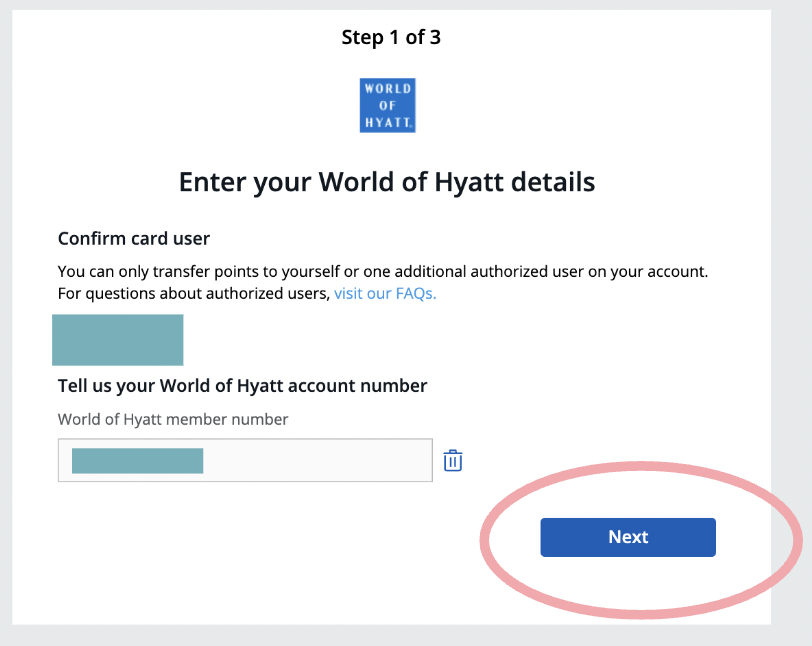

3. Link Your Accounts:

- You’ll need to link your Chase account with your selected airline or hotel program. This typically involves entering your loyalty program numbers with the hotel or airline brand.

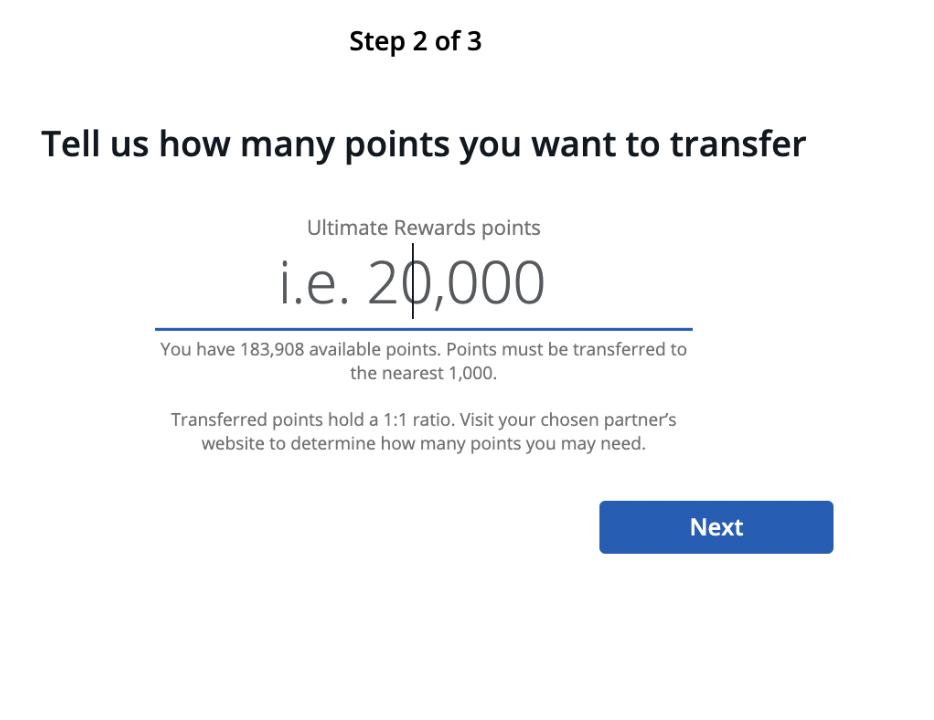

4. Transfer Your Points:

- Decide on the number of points you’ll need. Generally, you have to transfer in increments of 1,000. And I rarely recommend transferring over more than what you need. I like to keep as many points as I can flexible and only transfer what I need that moment. Typically transfers are immediate but in some cases, it can take 24-48 hours depending on the transfer partner.

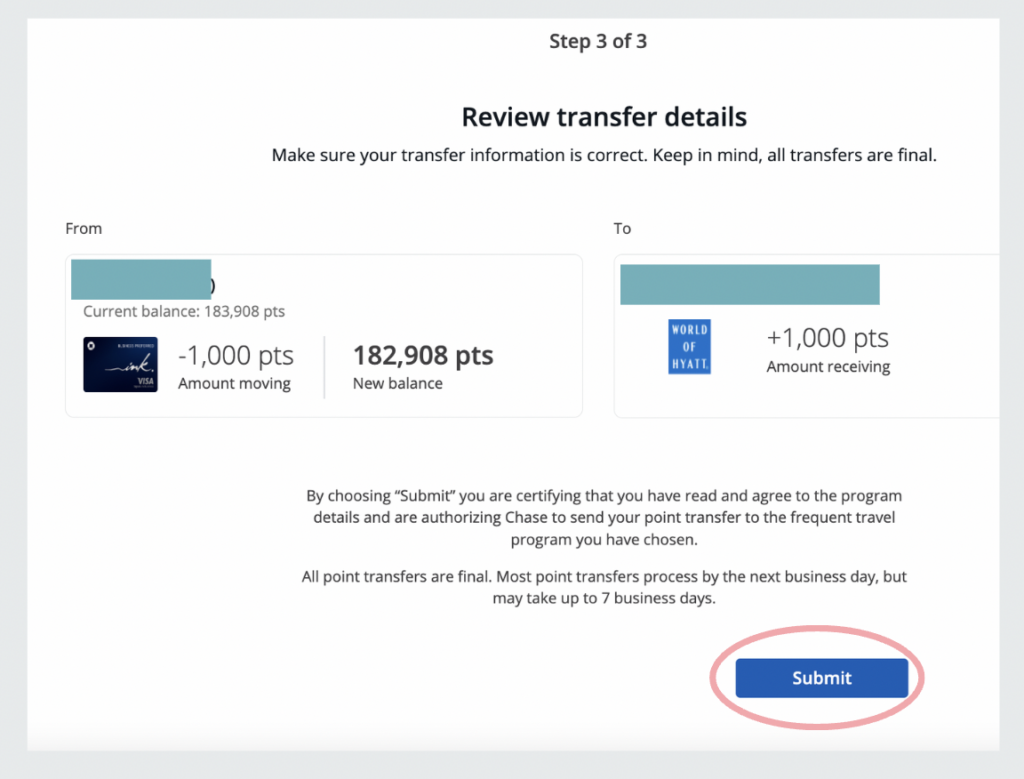

5. Verify Your Transfer:

- Verify your transfer and hit “submit”. Then check your loyalty program and ensure the points have arrived. This is where things get so exciting and you can book those nearly free flights and those hotels on points! *If you don’t see the points in your loyalty accounts, I always like to log out and then log back in.

Tips for Getting the Most Out of Your Points:

- Seek Out Redemption Sweeet Spots: Every airline or hotel program has its sweet spots for redemption. My favorite Chase transfer partners are Hyatt, Southwest, Virgin Atlantic, Singapore Air, and Flying Blue.

- What for Transfer Bonuses: Occasionally Chase offers bonus points for transferring to specific partners. Keep an eye out for these opportunities to get even more points when you transfer.

- Keep Your Options Open: While sticking with one loyalty program might be tempting, exploring multiple options between transfer partners can lead to discovering some pretty cool opportunities (like lay-flat business class seats to Europe, or an incredible 5-star stay in Fiji for free!) and will help you get the most from every point.

Wrapping it Up

Transferring our Chase points is one of our favorite ways to book nearly free travel for our family and it allows us to take our dream vacations together for a fraction of the cost! Once you learn how to transfer your points, you can transfer your normal spending into amazing travel with your crew.

I can’t wait to see where your points take you!

Check out all of the best credit cards here!

Our Family Passport has partnered with CardRatings for our coverage of credit card products. Our Family Passport and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.