The Easiest Way to Keep Track of Credit Card Benefits

If you have premium travel credit cards, you know the drill: you're paying hundreds of dollars in annual fees for cards loaded with statement credits, travel rewards, and valuable perks. These cards can be incredible, and those benefits and statement credits can really help offset that annual fee. However, most credit card companies are counting on you to forget about all those benefits and statement credits.

And it's working.

On average, most cardholders use less than 30% of their credit card rewards and benefits (Guilty!). That means if you're paying a $495 annual fee, you're potentially leaving $300-500 (or more) in statement credits on the table every single year. These credits have expiration dates, and once they're gone, they're gone.

Why Tracking Credit Card Benefits Is So Hard

Monthly credits. Quarterly credits. Semi-annual credits. Annual credits. Some reset on the 1st of the month. Some reset quarterly. Some resets on your account anniversary. And don't even get me started on which ones require enrollment.

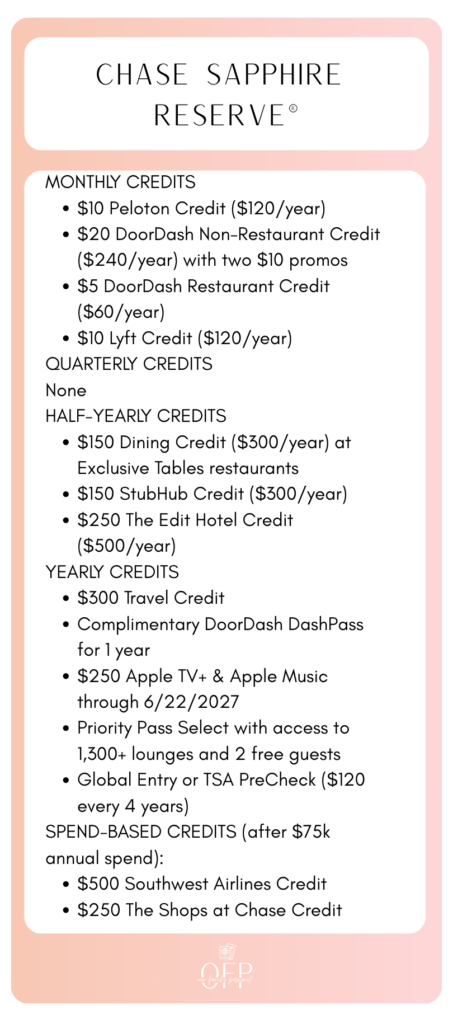

I see this constantly with the families I work with. They have the best travel credit cards, like the Chase Sapphire Reserve®, The Platinum Card® from American Express, and the Capital One Venture X Rewards Credit Card, and they're drowning in benefits they can't keep track of, and so they usually go to waste.

Because who can possibly keep track of it all?

How I Left $400 in Credit Card Benefits on the Table

I teach families how to maximize credit card rewards and use points and miles for travel. This is literally my job. And even I've been terrible in the past at tracking my own credit card benefits.

A few Decembers ago, I found myself staying up until midnight a few nights before the end of the year, realizing that I had hardly used up the credits I had paid for. "Wait, did I use my Saks credit? Oh no, I have $200 in airline fees sitting there unused. When does my hotel credit expire again?" I ended up frantically buying gift cards and booking random stays just to avoid losing the money I'd already paid for.

I left over $400 on the table across my cards. Four. Hundred. Dollars. That could have been a flight. That could have been two nights in a hotel. Instead, those statement credits just... expired.

The Real Problem with Tracking Statement Credits and Expiration Dates

The problem isn't that we don't care about maximizing our travel rewards. The problem is that keeping track of 15+ different credits across multiple premium credit cards, each with their own expiration dates and redemption rules, is genuinely overwhelming.

→ Check out and compare our favorite premium cards here!

So after losing $400 one year, I decided enough was enough. I needed a simple credit card benefits tracker that actually worked. Not another app. Not another spreadsheet. Just something I could pull up on my phone whenever I needed it. So I came up with a really simple and free system that worked for me.

Different Ways to Track Credit Card Benefits (And What Works for Us)

There are a few different approaches people use to track their credit card rewards and benefits:

Credit Card Tracking Apps: There are several apps out there designed specifically for this. They can send you push notifications and track expiration dates. If you love apps and want something automated, those might work great for you. Uthrive is a great option if you want something like this.

Spreadsheets: Some people create detailed spreadsheets tracking every credit across every card. I LOVE a good spreadsheet, so you're a spreadsheet person, more power to you. I found that a spreadsheet for my benefits was just too convoluted and overwhelming.

Physical Trackers: I've seen people print out monthly trackers and keep them in their wallet or planner. Very analog, but it works.

My Method: Simple reference cards I had created saved on my phone and favorited so I could access them at anytime. (The first reference cards I created were in my notes tab and they were NOT cute, but I found out they were wildly effective.)

Why I LOVE These Simple Reference Cards

Here's why I personally don't use apps for my benefits: It's just another thing for me to remember. Another login. Another app to update. Another notification was fighting for my attention, and then I found I was often upsold and ended up buying more than I needed when using my statement credits.

I'm a mom to a blended family of six, running a business, homeschooling a dyslexic 6th grader, and trying to stay sane. Simple and inexpensive wins every single time.

For me, having a reference card saved on my phone that I can pull up in two seconds while I'm standing in Saks or booking a hotel? That's as easy as it gets. No login required. No updates needed. Just open my photos, scroll to the card, done.

Is it as fancy as an app? Nope. But it works, it's fast, and I actually use it, which is the whole point.

If you're like me and you just want the simplest possible solution that doesn't require yet another thing to manage, these free reference cards are your answer.

How We Use Our Credits and Our Reference Cards

Once you get a handle on the credits you have and how you use them, you can really determine whether a high-annual-fee card is right for you! If you are using your credits and you're offsetting that annual fee year after year - that's a good sign! If you find that you aren't using the credits very often, then it might be time to reassess.

How to Actually Use Your Credit Card Benefits

Here are some of my go-to strategies for maximizing our credit card statements & benefits:

Using Travel Credits for Everyday Trips

- I use my $200 airline credit from The Platinum Card® from American Express for Southwest flights under $100. I'll book two separate flights and boom, credit used on travel I was already planning to take.

- The Capital One Venture X Rewards Credit Card $300 travel credit and other hotel credits (except Fine Hotels + Resorts, more on that in a sec) are perfect for positioning stays at airport hotels or weekend tournaments for my kids. Not glamorous, but incredibly practical.

- For Airbnb stays, I use the Citi Strata Elite Mastercard® splurge credit to buy Airbnb gift cards at Best Buy, then use them throughout the year to offset our family stays.

Making Statement Credits Work for Special Experiences

- Resy credits are my favorite for date nights. And here's a secret: some restaurants will trigger the credit even when you're buying a gift card, so I'll sometimes grab those for future use or to give as gifts. Also, I don't live in NYC or LA, I live in Utah, and there are still some awesome Resy restaurants that will trigger that credit. I had assumed for a while that we wouldn't have any decent options here where we live and I was wrong, so if you don't think that credit will apply to you, it's best to just check.

- The StubHub credit from the Chase Sapphire Reserve® is amazing when combined with any other family and friends who also have the Reserve. This time around, I'm taking my dad to a basketball game to see Steph Curry play. That's a memory, not just a statement credit.

- Fine Hotels + Resorts credit is where I go big. I love using it for incredible stays and then offsetting any extra costs with Amex points. Earlier this year, my husband and I combined our credits and got the Westin Anaheim completely covered. Zero out of pocket for a fantastic family trip to Disney.

Monthly Credits That Add Up Fast

- Dunkin' credit from the American Express® Gold Card ($7/month) is perfect for grabbing a sweet treat for a neighbor, teacher, or friend. It's such a small thing, but people love it.

- Google Workspace credit from the Chase Sapphire Reserve® for Business covers all our family accounts. Practical and actually useful.

- Oura Ring credit from The Platinum Card® from American Express pays for my monthly subscription. Set it and forget it.

Stacking Retail Credits with Sales

- Saks credit from The Platinum Card® from American Express: I always wait for sales and can usually find incredible shoes for my half-yearly credit. Designer shoes at 50% off plus a statement credit? Yes please.

- Retail credits trick: I stack them with sales and Rakuten! This can be huge! If I'm earning on the credit AND getting points back, that's when I'll buy gifts for upcoming birthdays or holidays.

The point is, these statement credits aren't just for luxury splurges, and if you are able to better keep track, you'll find that they can often totally make the annual fees you're paying worth it, especially if you are maximizing your points earned. If you find that you still aren't using them, it's probably a good idea to let that card go and move on to something a bit more economical.

How to Grab & Use These Credit Card Benefits Reference Cards

It's so simple, and I'm so excited for you to give it a try! We have free reference cards for 11 premium flexible-earning credit cards with high annual fees, and they are the best.

- Find your card(s) below (if you have multiple premium credit cards, grab all of them)

- Screenshot it or download it to your phone

- Save it to your Photos or add it to your Favorites

- Pull it up when you're shopping, booking travel, or just need a reminder of what benefits you have

No app to download. No bank account to connect. No login to remember. Just a quick reference card on your phone that tells you exactly what credit card rewards you have and when their expiration dates are.

The 11 Best Premium Travel Credit Cards with Statement Credits

We focused on the best credit cards with the most valuable benefits and the most flexibility for earning transferable travel rewards. These are the rewards credit cards we recommend most often to families who want to maximize their credit card benefits:

American Express Cards:

- American Express® Business Gold Card

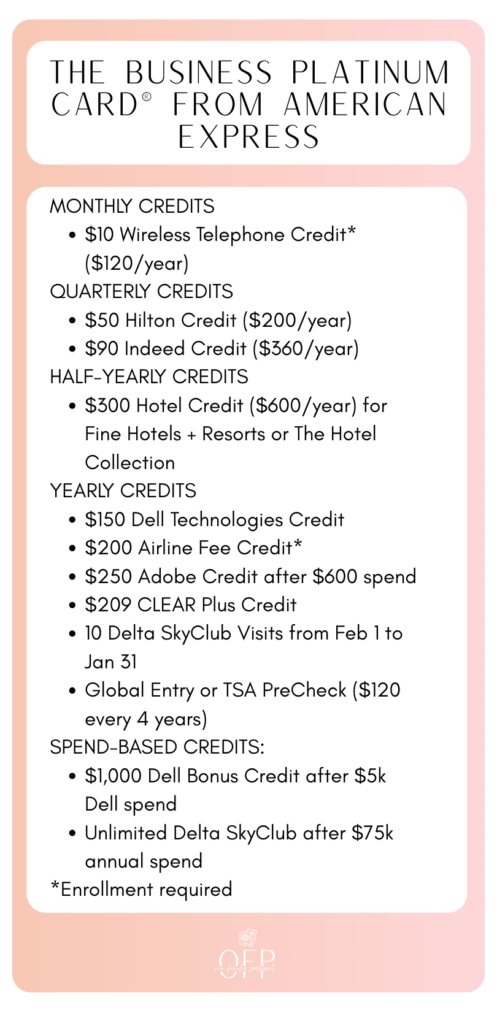

- The Business Platinum Card® from American Express

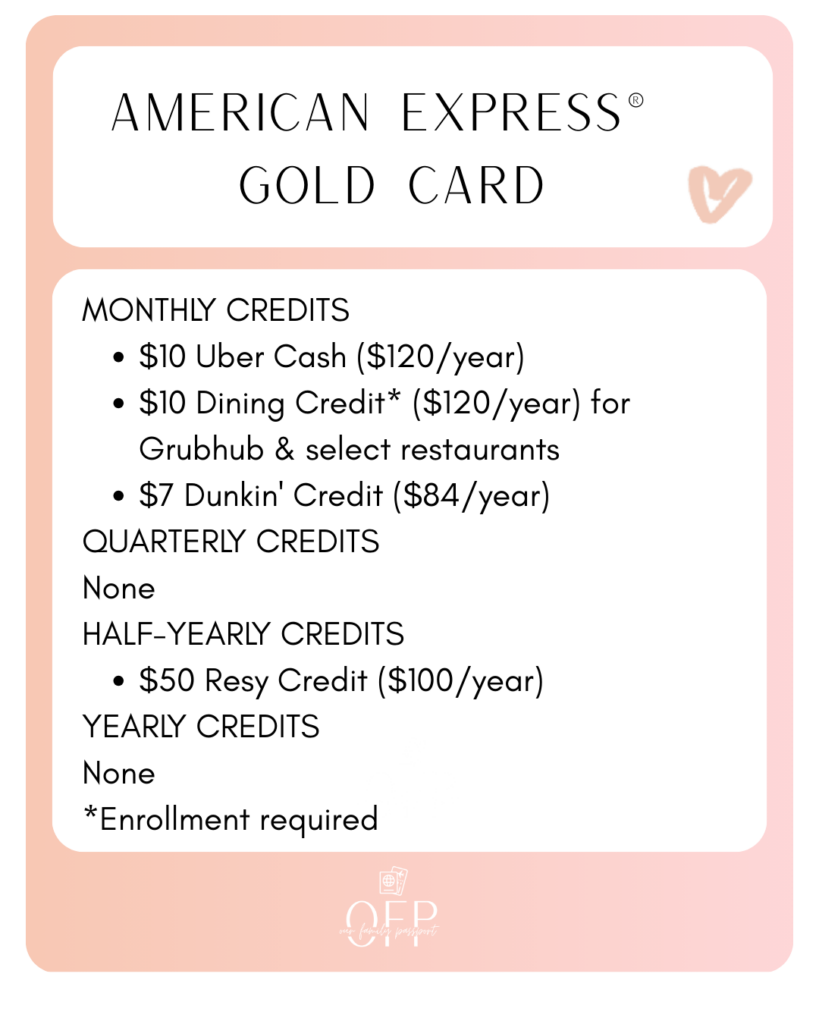

- American Express® Gold Card

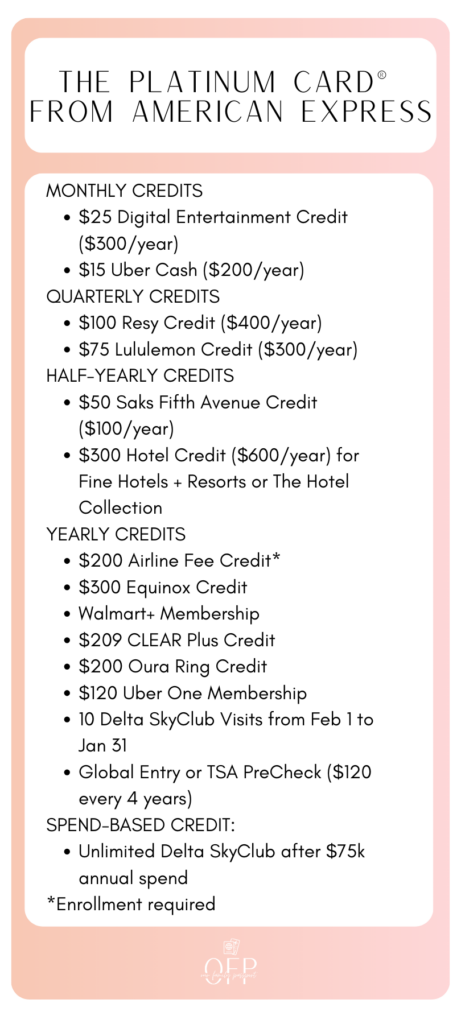

- The Platinum Card® from American Express

Capital One Cards:

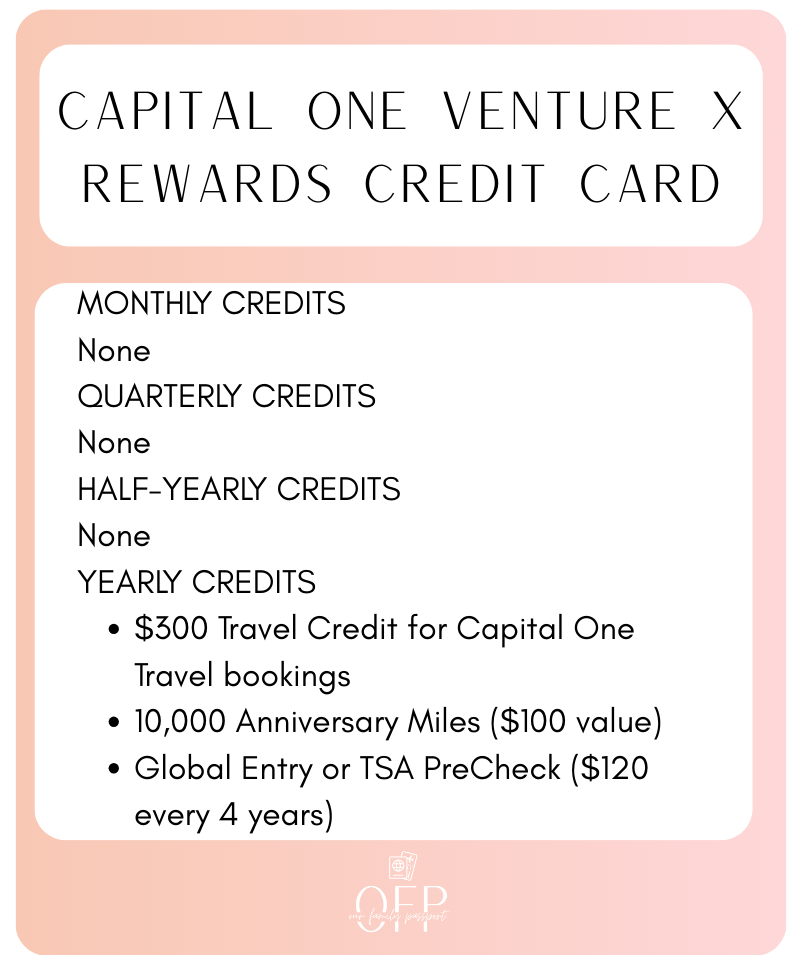

- Capital One Venture X Rewards Credit Card

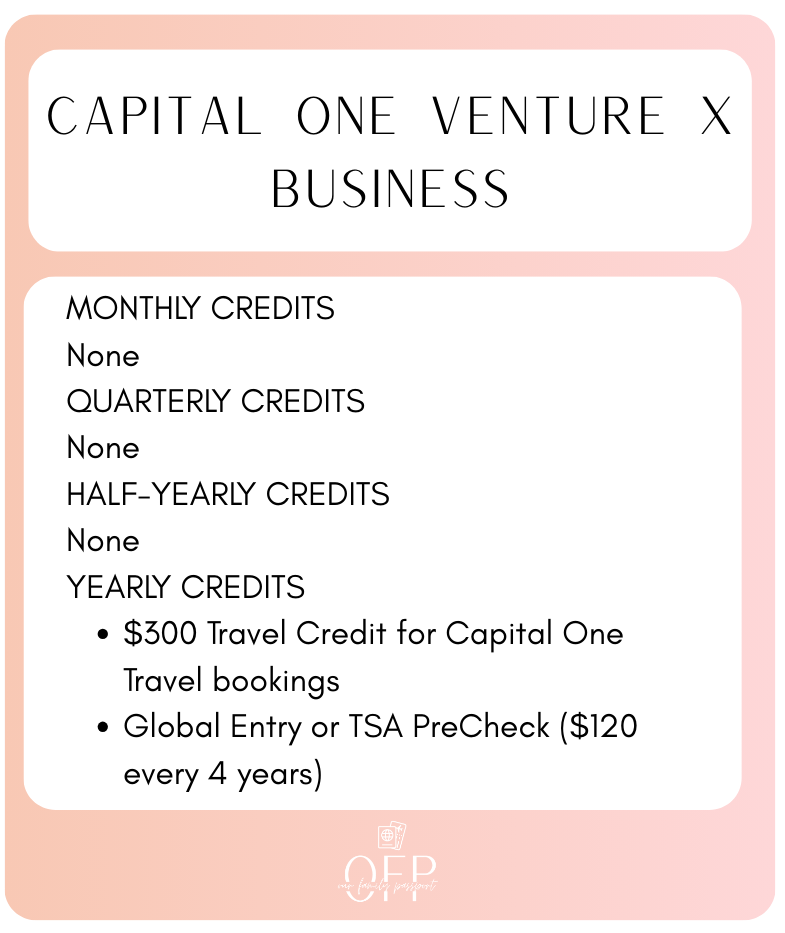

- Capital One Venture X Business

Chase Cards:

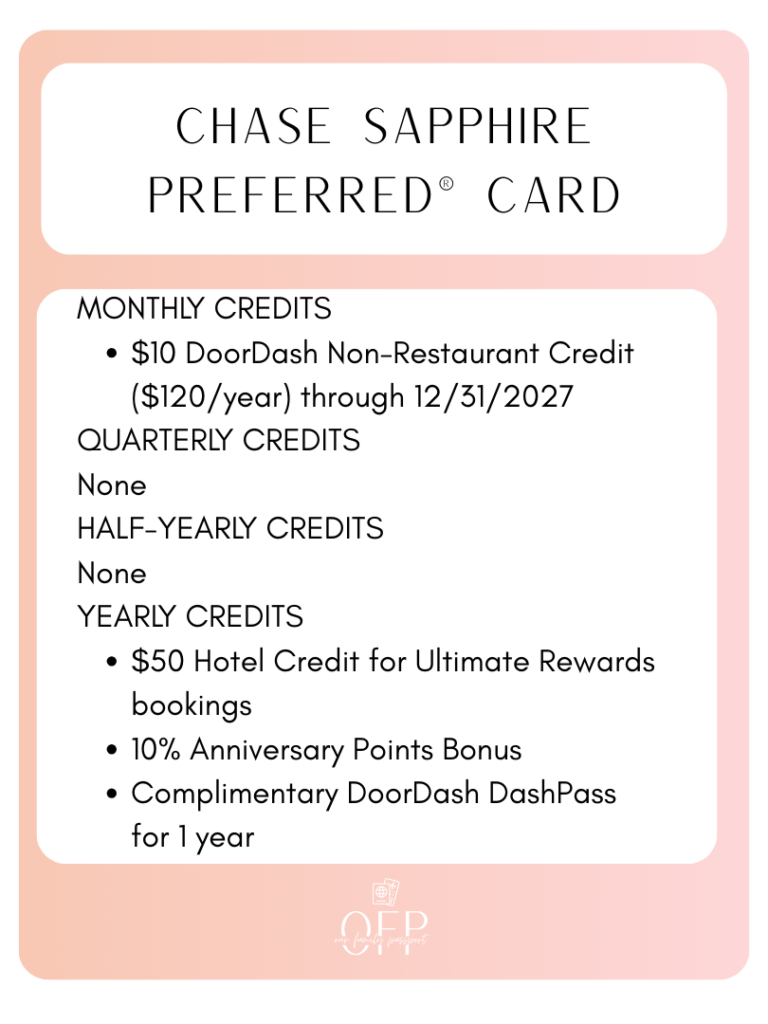

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

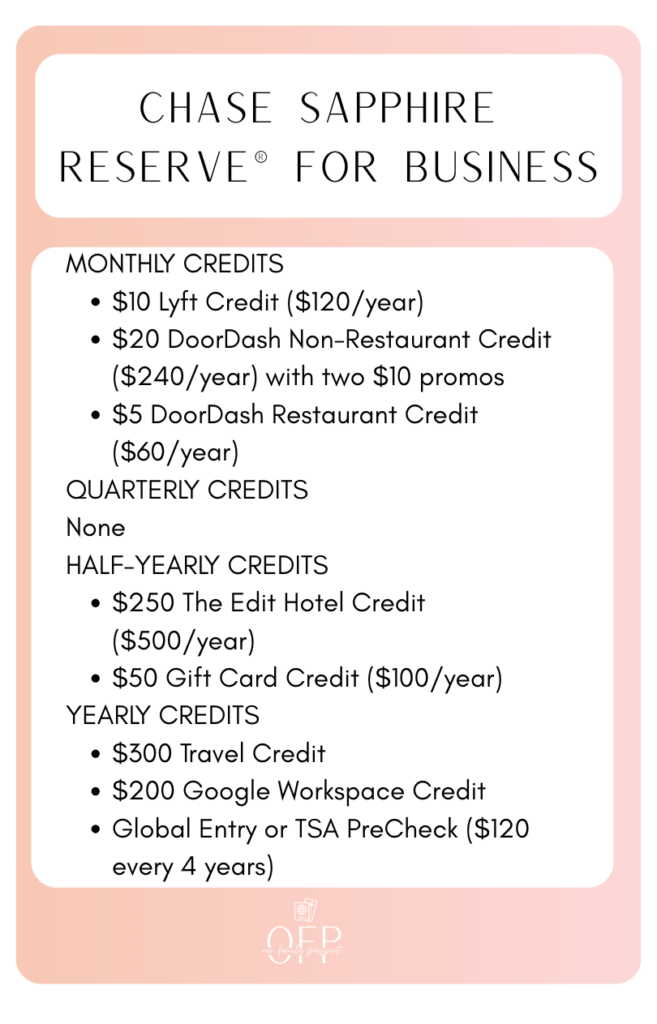

- Chase Sapphire Reserve® for Business

Citi Cards:

- Citi Strata Elite Mastercard®

Bilt Cards:

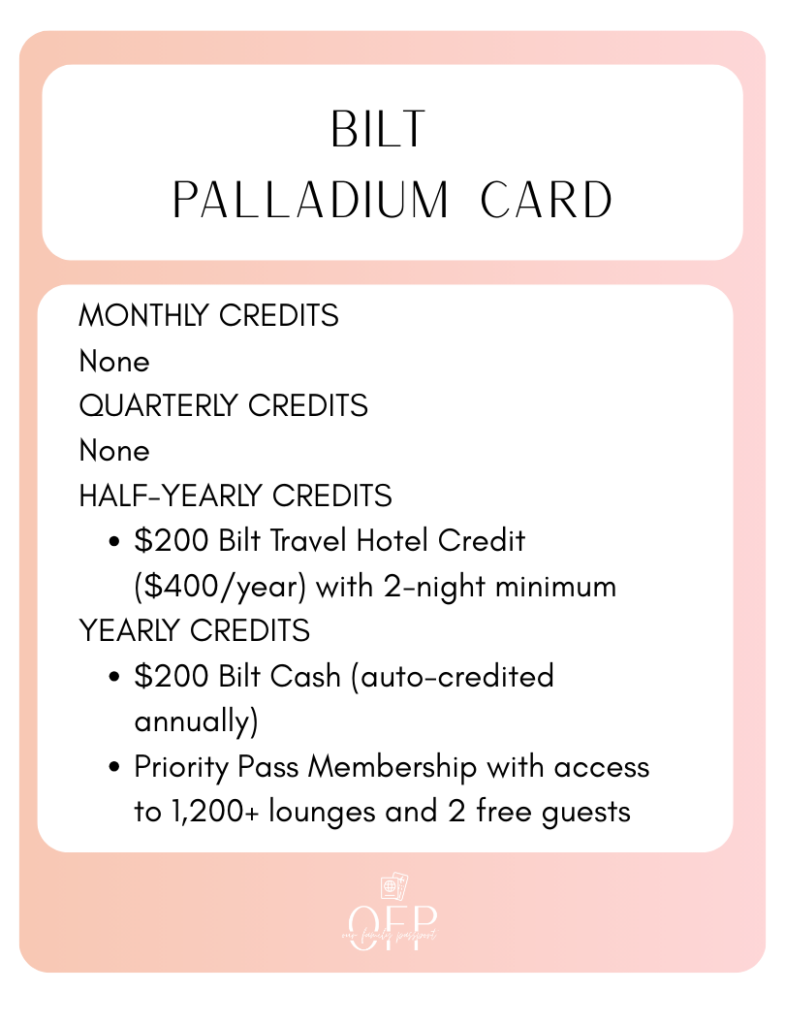

- Bilt Palladium Card

compare

Cards

Grab Your Credit Card Benefits Reference Card(s)

Each reference card shows you exactly what benefits come with that card, organized by how often they reset (monthly, quarterly, half-yearly, or yearly). No more guessing. No more "wait, do I have that credit or not?" No more scrambling before expiration dates.

Other posts you may like

Other posts you may like

No related posts found.

What do you want to read today?

Search

DISCOVER MORE

Bringing Travel Inspiration to Your Inbox

Forget the spam—I’m delivering real travel saving tips straight to your inbox. Get actionable advice, practical tips, and actionable travel guides designed to help you create unforgettable family memories. Ready to make your next adventure amazing and affordable? Let’s go!

LET’S CONNECT

& make your next adventure unforgettable! Whether you’re looking for tips on booking with points or just need some wanderlust inspiration, we’re here to help you every step of the way.

save big on your next family adventure!

GET A FREE POINTS & MILES GUIDE

Get exclusive access to our free guide on how to use points and miles for family travel, plus receive the latest deals, tips, and insider tricks straight to your inbox.