How to Apply for Reward Travel Credit Cards with Confidence

If you're new to travel credit cards, the application process might feel a little intimidating. However, here's the truth: getting approved is more straightforward than you think when you know what to expect and how to set yourself up for success.

Whether you're applying for your very first travel card or adding another one to your wallet, these guidelines will help you approach each application with confidence.

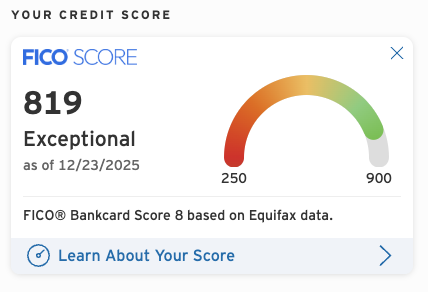

Check Your Credit Score First

Most travel rewards credit cards require good to excellent credit for approval. Generally speaking, you'll want a credit score of at least 700, though premium cards with higher annual fees typically look for scores closer to 730+ or above.

The good news? Checking your credit score is free and easy. You can access your credit report weekly at AnnualCreditReport.com, and many banks and credit card issuers now offer free FICO score tracking to their customers. Even if you don't have a credit card yet, services like Credit Karma provide free credit scores.

If your score isn't quite where it needs to be, don't worry! You can build your credit by starting with a secured card or becoming an authorized user on someone else's account. Your score can also improve drastically if you make sure all of your payments are on time, every time.

Space Out Your Applications

One of the biggest mistakes I see families make is applying for too many cards at once. Here's why spacing matters: each credit card application creates a "hard inquiry" on your credit report, which can temporarily lower your score by a few points.

More importantly, applying for multiple cards too quickly raises red flags with banks. They might wonder if you're in financial trouble or planning to max out your cards and disappear.

My recommendation: Try to wait at least 3 months between applications. This gives you time to:

- Earn and redeem your welcome bonus

- Learn how to maximize the card's benefits

- Thoughtfully plan which card complements what you already have

- Give your credit score time to bounce back from the small dip it will take following an application

There are also bank-specific rules to keep in mind. For example, Chase has what's called the "5/24 rule" which means if you've opened 5 or more cards in the past 24 months, they'll automatically deny your application. Different banks have different quirks like this, so it pays to do a little research before you apply (or use all of our resources!).

Use Your Household Income

This is HUGE and so many people don't realize it's allowed!

If you're 21 or older and married or living with a partner where you share finances, you can include your household income on credit card applications. This means if one partner works and the other stays home with kids, the stay-at-home parent can still apply for credit cards using the household's total income.

Why does this matter? Because card issuers want to see that you have enough income to make your payments. If you're only listing your individual income when you actually have access to your household's combined income, you're making it harder on yourself for no reason.

What counts as household income? Any income you have "reasonable expectation of access to," including:

- Your spouse or partner's salary

- Investment income

- Social Security benefits

- Pension distributions

- Alimony or child support

- Consistent financial support from family (if you're a student living at home)

- Any extra income that comes into your home

Important: If you're under 21, you can only list your own personal income. And roommates sharing expenses but keeping separate bank accounts? That doesn't count as household income.

Keep Your Information Current and Accurate

This sounds obvious, but it's worth saying: make sure all the information on your application is accurate and up to date.

Double-check that you're using:

- Your current address

- Your current employer and job title

- Your actual income (be honest, but remember you CAN include household income)

- A phone number and email you check regularly

- And double-check that your social security number is accurate before you hit submit

Card issuers sometimes need to verify information or ask follow-up questions, and if they can't reach you, your application might get denied. I've seen this happen!

Also, never inflate your income, thinking it will help your chances. Card issuers can (and sometimes do) ask for proof of income, especially for higher credit limits. It's better to be honest.

Track Your Application Dates and Status

Here's something that catches a lot of people off guard: the clock for earning your welcome bonus usually starts when your application is approved, not when you receive your card in the mail.

This means you should:

- Set a reminder for when your spending window ends (usually 3-6 months from approval)

- Track your spending to make sure you'll hit the minimum requirement

- Check your application status if you don't receive a decision right away (most banks have phone lines just for this)

We have an awesome free Credit Card Tracker that you can use to help you keep track of:

- Card name

- Application date

- Approval date

- Spending requirement and deadline

- Welcome bonus amount

- Annual fee and when it's due

- ... and more!

You can also use a note in your phone, or a credit card tracking app. Whatever works for you! The important thing is having this information in one place so you can stay on top of it.

A Few More Tips for Success

Time Your Applications Strategically: If you know you have a big expense coming up (home insurance, property taxes, a vacation booking, home repairs), apply for a new card a week or two before you need to make that purchase. This way, you can knock out a huge chunk of your minimum spending requirement all at once without spending extra money.

Keep Your Credit Utilization Low: Try to keep the total balance on all your cards below 30% of your total available credit. So if you have $10,000 in total credit limits across all your cards, try to keep your total balance below $3,000 at any given time. This is one of the biggest factors in your credit score.

Don't Close Your Oldest Credit Card: Even if you're not using the card anymore, keeping it open helps your credit score by contributing to your length of credit history and overall available credit. If there's an annual fee you don't want to pay anymore, call the bank and ask if you can downgrade to a no-annual-fee version of the card instead of closing it.

Use Referral Links When You Can: Here's a bonus tip: if someone you know is applying for one of the same cards you already have, check if your card offers a referral program! Many credit cards let you generate a referral link that gives YOU bonus points when someone applies through your link. It's a win-win - they get the same great welcome bonus, and you earn extra points just for sharing.

Know About Reconsideration: If you get denied for a card, it's okay and it happens to the best of us! You can call the bank's reconsideration line and ask them to review your application again and get some more insight into why you were denied so you can address that issue in the future. Sometimes, a live person can look at additional information and reverse the decision. It never hurts to ask, and knowledge is power.

Use Pre-Qualification Tools When Available: Many banks offer pre-qualification tools on their websites that let you check if you're likely to be approved without affecting your credit score. While pre-qualification isn't a guarantee of approval, it can give you a good sense of your odds before you apply, and many of the links I have on this site offer pre-approvals.

Hold Off if You're Buying a Home Soon: If you're planning to apply for a mortgage soon, pause on opening new credit cards until you talk to your mortgage lender. Mortgage lenders look at recent credit inquiries and new accounts, and multiple new cards can raise red flags during the approval process.

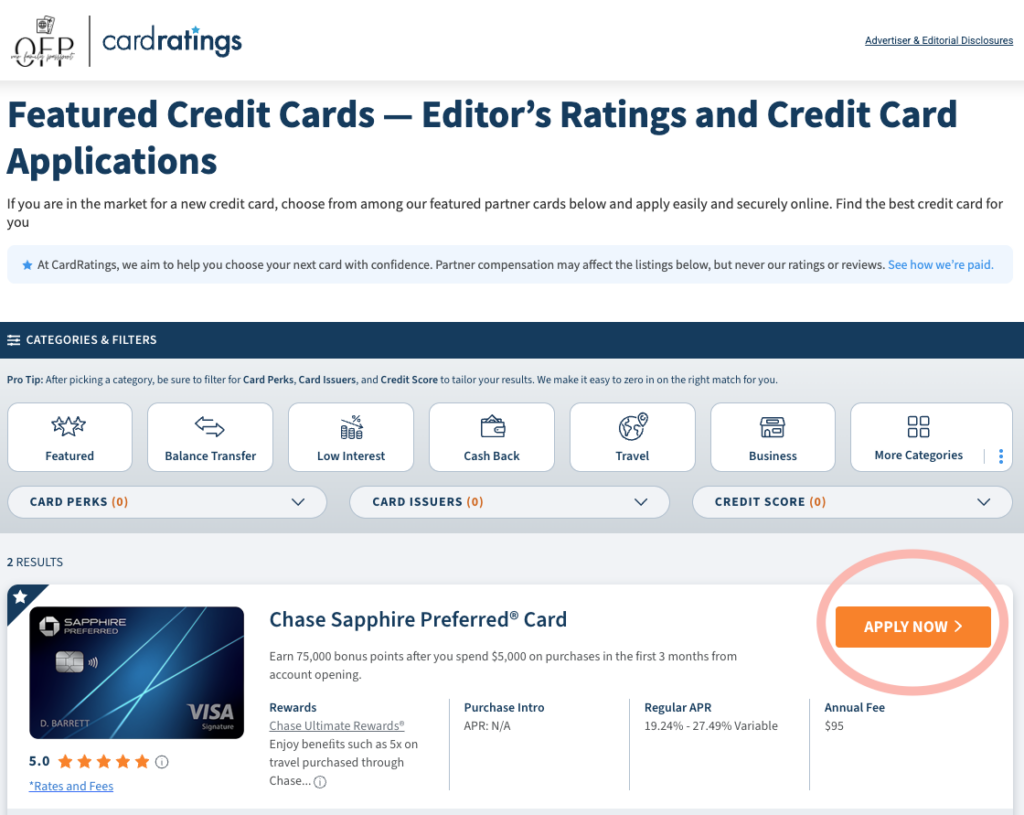

The Easiest Way to Apply for a Card

Ready to get started? The good news is that applying for a travel credit card through my site is actually the simplest way to do it. Instead of searching around for the best current offer or worrying about whether you're getting the right welcome bonus, everything is already vetted and ready for you in one place.

Here's how it works:

Thank You for Using My Links!

Before I show you exactly how to apply using my links, I want to tell you thank you for being here and for using my links!

Every time you click one of my links to apply for a credit card, you're supporting my small business. These affiliate commissions are how I'm able to keep creating free resources like this blog, my detailed guides, the quiz tool that helps match you with the right cards, and my consultation services.

Here's the thing: using my links costs you nothing extra. The public welcome bonuses and annual fees are the same. Whether you find it through my site or search for it directly, the public offers will be the same. The only difference is that when you use my link, the bank pays me a small commission for sending them a qualified applicant, and it helps my business so much.

I only recommend cards that I genuinely believe are the best options available, even if it means recommending cards I don't earn a commission from (because how else could you trust me?). My goal has always been to help families like mine afford the travel experiences I used to dream about, and your support through these links means so much. I truly believe that traveling helps everyone become better global citizens and understand the world around us. So thank you so much again for being here and supporting this site!

How to Apply Using My Links

Okay, here's the simple step-by-step process:

Step 1: Find the Card on My Site. Most cards on this site will be affiliate links; some won't be, and that just means that it's a card I recommend, but I don't earn a commission from. If you find a link on the:

- The quiz result page you received (if you took the quiz)

- My Best Cards for Beginners post

- Individual card reviews and guides

- My Start Here resources

- Or any other page

Then you are good and are most likely using one of my links.

Step 2: You'll be taken to the card landing page. Click the "Learn More" or "Apply Now" button, when you're ready to apply. Most cards I recommend have clearly marked buttons that will take you to the bank's application page. These buttons are my affiliate links. When you click them, a small piece of code is added to your browser session that tells the bank you came from my site.

Step 3: Complete Your Application Once you're on the bank's website, just fill out the application like you normally would. Remember all those tips we just talked about:

- Include your household income if applicable

- Double-check your information for accuracy

- Make note of the spending requirement and timeline

Step 4: That's It! The bank will process your application and send you a decision. If you're approved, they'll send your card in the mail (usually within 7-10 business days), and you can start working toward that welcome bonus! And don't worry, I don't get any information about the card applicant, but if you do get approved, I will get a commission.

A Quick Note About Tracking: The commission is tracked when you click my link and complete your application in the same browser session. If you click my link, then close your browser and come back later to finish the application by searching for the card yourself, the tracking won't work.

Don't worry if this sounds technical - just click the links and buttons here on this site and fill out the application, and you're all set!

I'm genuinely so grateful for this community and for everyone who trusts me enough to apply for cards through my recommendations. If you ever have questions about which card to apply for next or whether you're ready to add another card to your wallet, that's exactly what our free credit card consultations are for!

FREE EMAIL CONSULTATION

LET'S FIND YOUR IDEAL CREDIT CARD!

let's get you points!

Free consultation. Personalized recommendations. Zero pressure.

Other posts you may like

Other posts you may like

No related posts found.

What do you want to read today?

Search

DISCOVER MORE

Bringing Travel Inspiration to Your Inbox

Forget the spam—I’m delivering real travel saving tips straight to your inbox. Get actionable advice, practical tips, and actionable travel guides designed to help you create unforgettable family memories. Ready to make your next adventure amazing and affordable? Let’s go!

LET’S CONNECT

& make your next adventure unforgettable! Whether you’re looking for tips on booking with points or just need some wanderlust inspiration, we’re here to help you every step of the way.

save big on your next family adventure!

GET A FREE POINTS & MILES GUIDE

Get exclusive access to our free guide on how to use points and miles for family travel, plus receive the latest deals, tips, and insider tricks straight to your inbox.