Free Reward Travel Credit Card Spreadsheet Tracker

Keeping track of multiple credit cards shouldn't require a PhD, or a paid subscription to some app that wants access to your entire financial life.

I created this free comprehensive spreadsheet to help families stay organized when managing credit card rewards, annual fees, signup bonuses, and all the details that actually matter. No bank permissions required. No data sharing. Just a simple Google Sheet that lives in your own Google Drive.

Why Use a Spreadsheet Instead of a Tracking App?

There are plenty of credit card tracking apps and points-tracking services out there, and honestly, some of them are REALLY awesome. However, after working with thousands of families learning how to earn and use points and miles, I've found that simplicity and ease almost always win. Most of the current tracking apps on the market want one of three things: access to your bank accounts, access to what cards you have so they can market to you, and/or a monthly subscription fee.

For some, that isn't a big deal at all! For other families, a simple spreadsheet does the trick and more.

If you fit into the "simplicity and ease" group, this Google Sheet gives you everything you need while keeping things super simple. You decide what to track, when to update it, and who sees it. No algorithms are monitoring your credit card points or what cards you've opened. No third-party companies storing your financial data.

Here's what makes a spreadsheet great for most families:

Privacy and control - Your information stays in YOUR Google Drive. Period. You're not granting permissions to monitor your accounts or track your travel expenses across multiple loyalty programs. Once you make a copy of the template, it's in your drive, and you have full control and responsibility.

Customization - Want to track business cards separately from personal cards? Done. Need to note which business name you used when applying? Easy. Want to add an extra tab for your husband and your young adult child? This tracker adapts to however you manage your credit cards.

No learning curve - If you can fill out a basic spreadsheet, you can use this. No tutorial videos required.

Free forever - Unlike paid tracking services that charge $5-15/month, this Google Sheet costs you nothing. Ever.

If you don't love spreadsheets and you are all about apps, that's awesome! But if you're looking for a simple solution to keeping organized, it's this.

What You'll Track With This Free Spreadsheet

This isn't just a list of credit cards you own. It's a strategic tool for managing credit card rewards and maximizing signup bonuses without losing track of important details.

Card basics:

- Card name and date you applied

- Last five digits (for quick reference when calling customer service)

- Credit limits

- Annual fee amounts

Strategic tracking:

- Your 5/24 status and when cards roll off (crucial for Chase credit cards and Chase Ultimate Rewards points)

- Amex 5 credit card slots (for those co-branded Amex and Membership Rewards points-earning cards)

- Which business cards you have and the business name you applied with

- Sign-up bonuses you're currently working toward

- Spend thresholds for hitting welcome offers

- Key benefits like travel credits or airline miles bonuses

Account management:

- Open versus closed cards

- Date closed (important for your credit report and credit score)

- Notes section for retention offers, bonus requirements, or upcoming annual fees

Action planning:

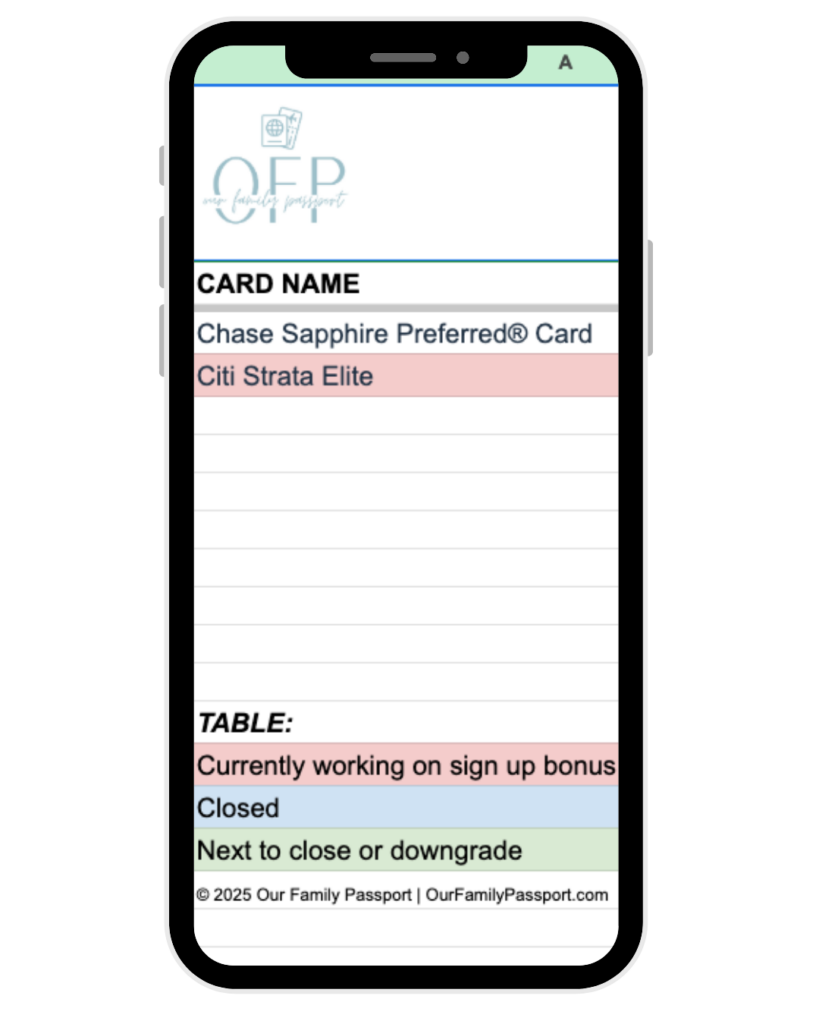

You'll also get a simple table at the bottom to track:

- Cards you're actively working on for welcome offers or bonus points

- Cards you've closed

- Cards coming up for review (to close, downgrade, or keep based on the annual fee)

Why Track This Information?

Protect your credit score - Knowing when you applied for new cards helps you space out applications strategically. Tracking when you close cards helps you maintain a healthy credit history.

Not totally sure how your credit score works? Check out our Crash Course where we break it down for you!

Maximize rewards - When you can see all your credit card points and airline miles in one place, you make better decisions about which card to use for travel expenses, and which loyalty programs to focus on next.

Need help understanding your point values? Our Points & Miles Calculator can help!

Avoid wasted annual fees - That premium credit card charging you $450/year? This tracker helps you to see all of the cards you have across different banks, so you can make sure every single one is working for you and not hitting your budget.

Plan new card applications - Before applying for new credit cards, you'll know exactly where you stand with Chase's 5/24 rule and Amex's credit card limits.

Manage business and personal cards - If you're using business cards for different ventures or booking travel with specific cards for bonus points, this keeps everything straight.

Make free travel possible - Organized tracking is a great way to turn credit card rewards into free vacations for your family. When you know exactly what points you have and when you're eligible for new bonuses, you can plan out that award flight or your card strategy without guessing.

A Few Tips When Opening New Credit Cards

Before you start filling in your tracker with new cards, here are some ground rules that'll save you headaches (and protect your credit score):

Space out your applications. It's best practice to wait about 90 days between new card applications. Your credit score takes a small hit with each application (it's nothing major it and will recover but it's something to know and be aware of), and you really don't want to apply for multiple cards in a short time period.

Only apply if you can meet the minimum spending requirements. Those sign-up bonuses are tempting, but if a card requires $10,000 in spending within three months and your normal expenses are $2,000/month, don't force it. Overspending to hit a bonus negates any value you'd get from the reward points. Be honest about your actual spending. If this is your first time applying for a rewards card, start with a spend threshold you're comfortable with.

Track your business card details obsessively. If you're applying for business cards, keep track in the tracker of the exact business name, EIN, or LLC you used on the application. You'll need this information if you ever want to apply for that same card again or need to reference it with the card issuer. Trust me, "I think I used my LLC?" is not something you want to tell the reconsideration line.

Never cancel before the 12-month mark. Closing a card before you've had it for at least a year is a red flag to card issuers. They'll see you as someone who's just chasing welcome offers, may deny future applications, and may even potentially claw your points back. Even if you hate the card, stick it out for a year before canceling.

Always ask for a retention offer first. Before you cancel any card, call and ask if they have any retention offers available. Sometimes they'll waive the annual fee, give you bonus points, or offer statement credits just to keep you as a customer. Worst case? They say no.

Pay your balance in full every month. This should go without saying, but credit card rewards are worthless if you're paying high interest rates on carried balances. If you can't pay off your spending each month, pause on new card applications and focus on paying down what you have.

Check your 5/24 status before applying for Chase cards. Chase has a hard rule: if you've opened five or more personal credit cards (from any issuer) in the past 24 months, they'll automatically deny your application. Use your tracker to count before you waste a hard pull on your credit report.

Make sure the card fits your actual travel goals. Don't apply for hotel cards if you always book vacation rentals. Don't get airline miles cards if you prefer flexible points. The best travel credit cards are the ones that match how your family actually travels.

Your tracker will help you stay on top of all of this. When you can see your application dates, minimum spending requirements, and card details in one place, you make smarter decisions about when and what to apply for next.

How to Use Your Free Credit Card Tracker

Getting organized with your credit card rewards is easier than you think. This tracker is the first step toward managing points strategically instead of letting them sit unused or expire.

Step 1: Enter your email to have access to the Google Sheet sent directly to your inbox.

Step 2: Hit the big blue "Make a copy" button. Then the tracker will save directly to your own Google Drive - completely private, completely yours.

Step 3: Fill in your current cards. Start with card name, annual fee, and application date. Add other details as you go.

Step 4: Use the action table at the bottom to flag which cards you're working on for signup bonuses, which you're planning to close, and which are already closed.

Step 5: Update it whenever you apply for a new card, hit a spending threshold for bonus miles, or close an account, and then you can share it with your spouse/partner or your player two.

That's it. This is the exact tracker I use to manage our family's credit card strategy for free travel. Nothing fancy, just organized.

A Note About "Churning" vs. Smart Strategy

You might hear terms like "credit card churning" thrown around. This tracker isn't about gaming the system or exploiting loopholes. It's about being organized, responsible, and strategic with credit card rewards so you can reduce travel costs for your family without overspending or damaging your credit score.

The families who get the most value from credit card points aren't the ones opening a bunch of new cards in a few months. They're the ones who:

- Track their annual fees and actually use the benefits

- Know when they're eligible to apply for new credit cards

- Understand which loyalty programs align with their travel goals

- Keep their cards, cancellations, and information organized

This spreadsheet helps you do exactly that.

Free Download: Credit Card Tracker Spreadsheet

Ready to get organized? Enter your email in the box above, and we'll send you instant access to the tracker, plus my best tips for applying for that next card.

FREE EMAIL CONSULTATION

LET'S FIND YOUR IDEAL CREDIT CARD!

let's get you points!

Free consultation. Personalized recommendations. Zero pressure.

Ready to Level Up?

Want to master this for the long haul?

If you’re ready to learn how to integrate all the banks and programs so you can book reward travel for a lifetime (not just one trip), join the waitlist for Travel Reward University. It’s our comprehensive course that teaches you the entire system, from earning strategies to booking complex business class award flights across all the major programs.

Other posts you may like

Earning Points

Is the Chase Sapphire Preferred® Card Worth It?!

What do you want to read today?

Search

DISCOVER MORE

Bringing Travel Inspiration to Your Inbox

Forget the spam—I’m delivering real travel saving tips straight to your inbox. Get actionable advice, practical tips, and actionable travel guides designed to help you create unforgettable family memories. Ready to make your next adventure amazing and affordable? Let’s go!

LET’S CONNECT

& make your next adventure unforgettable! Whether you’re looking for tips on booking with points or just need some wanderlust inspiration, we’re here to help you every step of the way.

save big on your next family adventure!

GET A FREE POINTS & MILES GUIDE

Get exclusive access to our free guide on how to use points and miles for family travel, plus receive the latest deals, tips, and insider tricks straight to your inbox.